Efficient national tax systems critical for sustainable development and inclusive growth, urge UN, partners

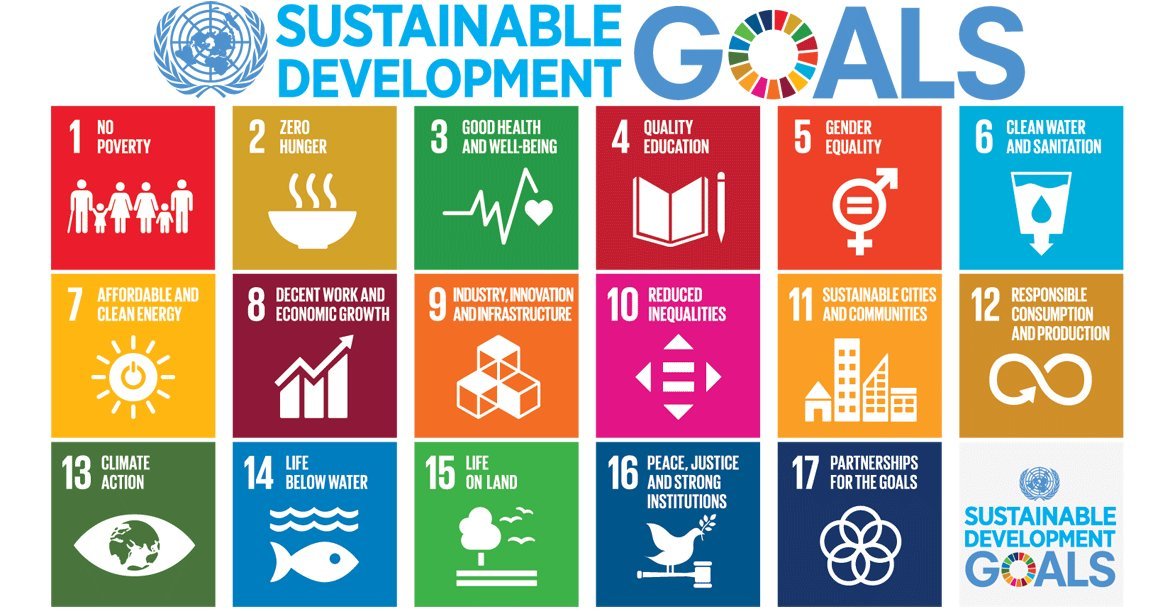

Countries need to strengthen the effectiveness of their tax regimes to unleash much-needed domestic resources to ensure the realization of the Sustainable Development Goals (SDGs), as well as the promotion of inclusive economic growth, United Nations and as key international economic and financial organizations have urged.

At a three-day conference, from 14-16 February, held at UN Headquarters, in New York, under the theme of taxation and SDGs, the United Nations, World Bank, International Monetary Fund (IMF), and Organisation for Economic Co-operation and Development (OECD) also urged support for developing countries to address tax transparency and base erosion and profit shifting, including on treaties.

“I call upon the international community to establish effective mechanisms to combat tax evasion, money laundering and illicit financial flows, so that developing countries could better mobilize their own resources,” the UN Secretary-General, António Guterres, said at the opening of the forum

In the same vein, IMF Managing Director Christine Lagarde underscored that funding the global development goals is an economic and ethical imperative and that it has major implications for taxation.

“Countries themselves need to raise more revenue in an equitable way. And the entire international community needs to eradicate tax evasion and tax avoidance,” she noted.

Domestic resource mobilization presents a challenge for developing countries, who need to raise tax revenue of at least 15 per cent of their gross domestic product (GDP) to be able to provide basic services, such as infrastructure, health care and public safety.

Presently, in almost 30 of the 75 poorest countries, tax revenues are below this threshold.

At the same time, more advanced economies need to pay greater attention to spillovers from their tax policies and step up their support for stronger tax systems in developing countries.

All countries and stakeholders need to continue working together on establishing a fair and efficient system of international taxation, including efforts to fight tax avoidance and tax evasion, the organizations urged.

At the same time, good governance is also critical.

According to Jim Kim, the President of the World Bank Group, fair and efficient tax systems, “combined with good service delivery and public accountability, build citizens’ trust in government and help societies prosper.”

“Effective taxation is essential to promote a more inclusive and sustainable growth. It is fundamental to making globalisation work for all,” added Secretary-General of the OECD, Ángel Gurría, noting that this is crucial for achieving the global development goals.

The conference, organized by the Platform for Collaboration on Tax (PCT), also provided a unique opportunity to address topics related to eradication of poverty, protecting the planet and ensuring prosperity for all.

It also provided an avenue to discuss the social dimensions of taxation, such as income and gender inequality and human development, as well as capacity development and international tax cooperation.

In a statement issued at the end of the conference, the four organizations announced the establishment of the Platform for Collaboration on Tax.

Subject to resource availability, the Platform intends to undertake or continue work in a range of areas, including strengthening international tax cooperation, building Institutions through medium term revenue strategies, and promoting partnerships and stakeholder engagement.

They also announced a list of immediate and concrete actions in these three areas, including the launch of a multi-year tax and SDGs programme, that will include components on taxation and health, education, gender, inequality, environment, and infrastructure; as well as establish a regular dialogue between the Platform and stakeholders – including, most importantly, the developing country.

• Read the full conference statement here.